Small Business Payroll Software for Windows

$219 In-House Small Business Payroll Software for Windows

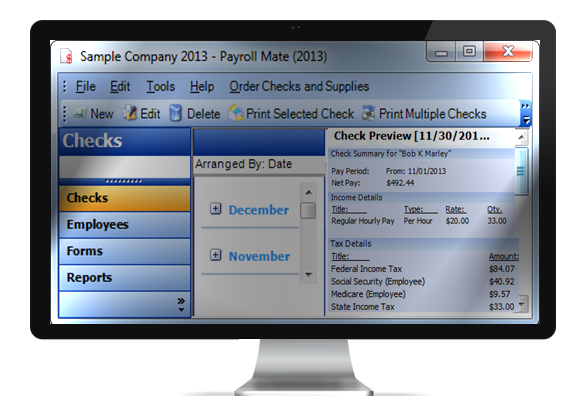

Payroll Mate® is in-house, stand-alone and desktop-based (runs locally on a desktop or laptop computer) small business payroll software for Microsoft Windows users that can process payroll, calculate payroll taxes, print checks with paystubs and generate tax forms. Payroll Mate offers a quick return on your investment literally paying for itself in a matter of one month.

No cloud, no monthly subscriptions, no down time, no security issues. You own your payroll records and your payroll software.

For $219 only, run payroll for up to 10 companies, with up to 75 employees per company for one calendar year.

Simple, Flexible and Affordable

Run payroll in-house and print payroll checks on your computer. Keep your payroll data safe and secure.

Pre-loaded tax tables for federal and state withholding.

Supports federal and state unemployment / disability taxes.

Calculates Social Security and Medicare Taxes.

Custom define any number of local taxes without limitations.

Highly customizable by providing the ability to define any type of pay, tax or deduction. The software is not limited by the built-in payroll items.

Supports salary, regular pay, overtime, double time and shift differentials.

Backup and restore capability to local disk, flash drive and more.

Vacation and Sick Pay Accrual.

Supports weekly, bi-weekly, semi-monthly and monthly pay periods.

Runs on Windows XP/ 2003 / Vista / 7 / 8 / 8.1 .

Prints MICR encoded checks for printing on blank check stock (Requires Payroll Mate Option #4 - Additional Fee)

Pay truck drivers with per-mile pay and farm workers with per-piece pay.

Supports payrolls over 10 million dollars, which is a limitation in other payroll software

Works for any type of business, tax practitioners, not-for-profits, banks and local governments.

Designed for any size business, from 1 to 1000 employees. If you process payroll for 10 or less companies (up to 75 employees / company) then you only need Payroll Mate for $219. You can add Payroll Mate Option #3 (for $100 more) if you want to process payroll for 100 or less companies (up to 1,000 employees / company).

US-based technical support.

Start at any time during the year and import employee information / payroll setup.

Includes special export capability for QuickBooks, Quicken, Sage 50 and Peachtree. Also includes a generic payroll export capability for any accounting software that can import general ledger information.

Creates NACHA files for doing direct deposit. (Requires Payroll Mate Option #2 - Additional Fee)

Handles all Salary Reduction Plans, 401(k), 403(b), 457, 501(c)18(D).

Handles Cafeteria Plans (Section 125), SIMPLE IRA, SEP, and others).

Pay stubs and checks can be exported to PDF and then emailed.

Easy payroll tax reporting, compliance, record keeping and data export / import capabilities.

Prepares and prints federal payroll forms 941 (Quarterly Federal, Social Security and Medicare Tax Return), 940 (Annual FUTA Tax Return), 943 (Annual Federal, Social Security and Medicare Tax Return for Farmers), 944 (Annual Federal Tax Return for employers who do not have to file form 941), W-2 (Annual Wages statement, sent to employees and the SSA ) and W-3 (Summary of W2 forms sent to the SSA).

Supports state forms for the states of California, Texas, New York, Illinois and Florida. For other states, Payroll Mate offers comprehensive reports that allows users to manually prepare their forms.

Prints forms 1099-MISC (Miscellaneous Income, mainly used for vendors and contractors) and form 1096 (Summary of 1099 forms filed with the IRS). (1099 and 1096 support requires Payroll Mate Option #6)

Quarterly and annual government forms can be printed at any time (as long as the form is available from the IRS for that year).

Download a free 30-day trial of our Payroll Mate® Payroll Software

LIVE CHAT

sales@realtaxtools.com

1-800-507-1992

Real Business Solutions

18313 Distinctive Drive

Orland Park, IL USA 60467

support@realtaxtools.com

1-708-590-6376

Fax: 1-708-590-0910